Dearest readers- or should I say gentlemen- I am back with an interesting topic I have been researching and bugging lots of guy friends to debate, discuss and enrich for my benefit (haha) and yours. Lately, something has not been sitting with me nicely- not one bit. This entire idea about men spending too much time focused on things that make them happy versus actual dating, marriage and having children. Internet groups dominated by both guy and girl influencers and gurus, the news, clickbait articles... all of them seem to want to wag a finger at you guys and this has been on the rise for a while now. Well, this being a problem... I think they are lying to you- or at least trying to. My synthesized take on this, after putting in much work, is that they are lying to you quite a bit. I do not need to use a gentler word- my platform is my own. ;) So now, if that is a lie, what is the truth? The truth, I would say, is that men have an imposed history of being pulled away from life in the work life balance equation, and this is the first time you guys are successfully fighting back.

Let us look into it.

How about just the last hundred and twenty years or so? The Industrial Revolution, which began in the late 18th century and progressed through the 19th century, fundamentally transformed society. Men were required to work long hours in factories under harsh conditions, fostering a culture of relentless work ethic. This period ingrained the idea that a man's primary value was linked to his ability to work hard and provide financially, often at the expense of personal fulfillment and leisure. The cultural remnants of this era continued to influence societal expectations well into the 20th century, and thank goodness for Gen Z and Gen Alpha popularizing 5pm sign out trends on TikTok (including that Toodaloo lady- if you know, you know haha).

Now, let us fast forward to 1950's. Following World War II, there was a significant push toward rebuilding family units and stimulating economic growth through consumerism in places like the United States and Europe. The ideal of the male breadwinner was glorified, and the 'American Dream' often portrayed a happy family in a suburban home as the pinnacle of success. Men were encouraged to marry and have children as a measure of their societal worth. Personal pursuits that did not directly contribute to this family model were often viewed as selfish or secondary. Hmm, guess no one thought things that benefit you off the court also benefit you on it. Oh, and when you cannot take it any more, there are always vices (aka pleasures without moderation).

Fast forward some more, and we are in the 1980's. This period saw a surge in consumerism and the solidification of the corporate ladder as a path to success. The era's motto can be encapsulated in the phrase "Greed is good," from the movie Wall Street (worth having your older friends or movie buffs talk you into watching). Success was measured in terms of wealth and power, pressuring men to prioritize career advancement over personal well-being. This often meant long hours at the office and sacrificing health, hobbies, and quality family time for career growth. Men’s self-worth became increasingly tied to their professional achievements and less to their contentment or personal fulfillment. Of course, I always say there are exceptions to every cultural circumstance, but those are few and far between...

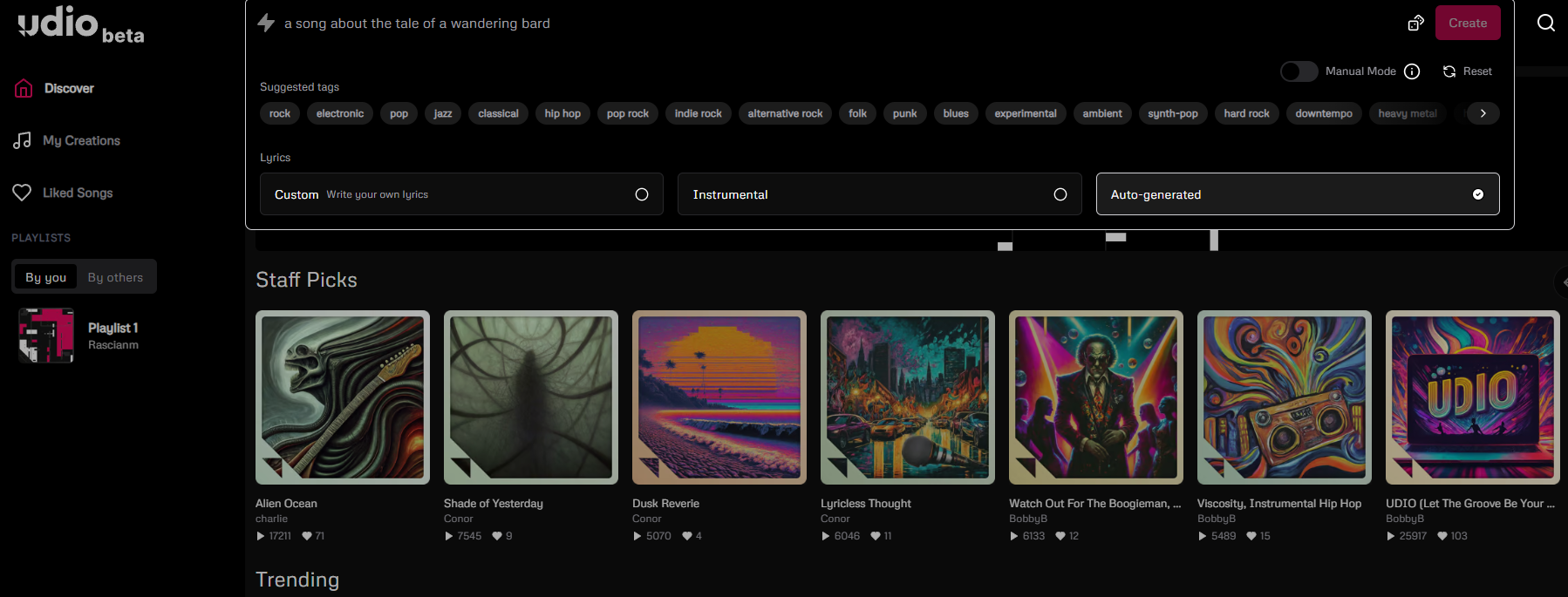

Finally, we arrive at the Online Age. :) Internet and smartphones have transformed how we communicate and what we value in relationships. Social media, in particular, has created platforms where people can curate and display idealized versions of their lives. This digital age has subtly pressured men to measure their success through online personas and achievements rather than personal happiness. However, it has also provided platforms for alternative narratives around masculinity, personal growth, and the importance of mental health, contributing to the shifting perceptions towards personal time and fulfillment. So, maybe reality is contrary to what some experts want to say about the digital age and social media. When I look at many of my friends' TikTok and YouTube feeds, I do not see nearly as much of the negative, toxic stuff that the media wants to make us believe dominates social media platforms. I see health information, nutrition, supplements, motivational videos, jokes and memes, news, fun science stuff, gaming, sports etc. A lot of the bad stuff that pops up is so easy to dismiss and mark as Not Interested- especially on TikTok (fast, easy, rarely requires an explanation).

Everyone in the West- myself included- praises individualism. However, there are forces out there that seem to conveniently forget that individualism is not formed in group settings- especially those that mandate individuals show up them and overly conform to them. Decentralization, fractioning, those seem to be confusing terms for individualism. Echo chambers- a dirty term- seem to seemly be free association groups of like-minded individuals- like-minded on one or more issues. Who are you as in individual guy? I think that is something you discover in two ways. One, by doing so outside of doing things and being in situations the society tells you to do and be in. Two, by devising your own value and priority system for things society tells you to embrace, and then approaching them accordingly in your own way as well. What is a society to do with this? Maybe, instead of a lazy approach to individualism, it is now time to have a hard working approach to it. :)

Let us look into it.

How about just the last hundred and twenty years or so? The Industrial Revolution, which began in the late 18th century and progressed through the 19th century, fundamentally transformed society. Men were required to work long hours in factories under harsh conditions, fostering a culture of relentless work ethic. This period ingrained the idea that a man's primary value was linked to his ability to work hard and provide financially, often at the expense of personal fulfillment and leisure. The cultural remnants of this era continued to influence societal expectations well into the 20th century, and thank goodness for Gen Z and Gen Alpha popularizing 5pm sign out trends on TikTok (including that Toodaloo lady- if you know, you know haha).

Now, let us fast forward to 1950's. Following World War II, there was a significant push toward rebuilding family units and stimulating economic growth through consumerism in places like the United States and Europe. The ideal of the male breadwinner was glorified, and the 'American Dream' often portrayed a happy family in a suburban home as the pinnacle of success. Men were encouraged to marry and have children as a measure of their societal worth. Personal pursuits that did not directly contribute to this family model were often viewed as selfish or secondary. Hmm, guess no one thought things that benefit you off the court also benefit you on it. Oh, and when you cannot take it any more, there are always vices (aka pleasures without moderation).

Fast forward some more, and we are in the 1980's. This period saw a surge in consumerism and the solidification of the corporate ladder as a path to success. The era's motto can be encapsulated in the phrase "Greed is good," from the movie Wall Street (worth having your older friends or movie buffs talk you into watching). Success was measured in terms of wealth and power, pressuring men to prioritize career advancement over personal well-being. This often meant long hours at the office and sacrificing health, hobbies, and quality family time for career growth. Men’s self-worth became increasingly tied to their professional achievements and less to their contentment or personal fulfillment. Of course, I always say there are exceptions to every cultural circumstance, but those are few and far between...

Finally, we arrive at the Online Age. :) Internet and smartphones have transformed how we communicate and what we value in relationships. Social media, in particular, has created platforms where people can curate and display idealized versions of their lives. This digital age has subtly pressured men to measure their success through online personas and achievements rather than personal happiness. However, it has also provided platforms for alternative narratives around masculinity, personal growth, and the importance of mental health, contributing to the shifting perceptions towards personal time and fulfillment. So, maybe reality is contrary to what some experts want to say about the digital age and social media. When I look at many of my friends' TikTok and YouTube feeds, I do not see nearly as much of the negative, toxic stuff that the media wants to make us believe dominates social media platforms. I see health information, nutrition, supplements, motivational videos, jokes and memes, news, fun science stuff, gaming, sports etc. A lot of the bad stuff that pops up is so easy to dismiss and mark as Not Interested- especially on TikTok (fast, easy, rarely requires an explanation).

Everyone in the West- myself included- praises individualism. However, there are forces out there that seem to conveniently forget that individualism is not formed in group settings- especially those that mandate individuals show up them and overly conform to them. Decentralization, fractioning, those seem to be confusing terms for individualism. Echo chambers- a dirty term- seem to seemly be free association groups of like-minded individuals- like-minded on one or more issues. Who are you as in individual guy? I think that is something you discover in two ways. One, by doing so outside of doing things and being in situations the society tells you to do and be in. Two, by devising your own value and priority system for things society tells you to embrace, and then approaching them accordingly in your own way as well. What is a society to do with this? Maybe, instead of a lazy approach to individualism, it is now time to have a hard working approach to it. :)